China’s weaponization of trade has become a persistent and growing source of concern for its partners. After years focused primarily on the risk that China would cut off access to rare earth minerals, which are essential to electronics, or other inputs vital to the military, the Biden administration last month announced a strategic review of supply chain risk in a broader array of sectors, including healthcare.

The supply chain disruptions prompted by the coronavirus have led many nations to start or accelerate efforts to encourage their companies to diversify their geographic exposure. China too has redoubled its aspirations for self-reliance, most notably in semiconductors, whose importance goes well beyond the technology sector to other vital industrial and military applications.

For some nations, it is China’s role as a customer, not supplier, that is the bigger threat. In recent months, Australian exports in a number of sectors have been subject to de facto bans; in 2017, Beijing orchestrated a similarly multifaceted boycott of South Korean goods, as well as restrictions on tourism, in protest of its decision to host an American antimissile system.

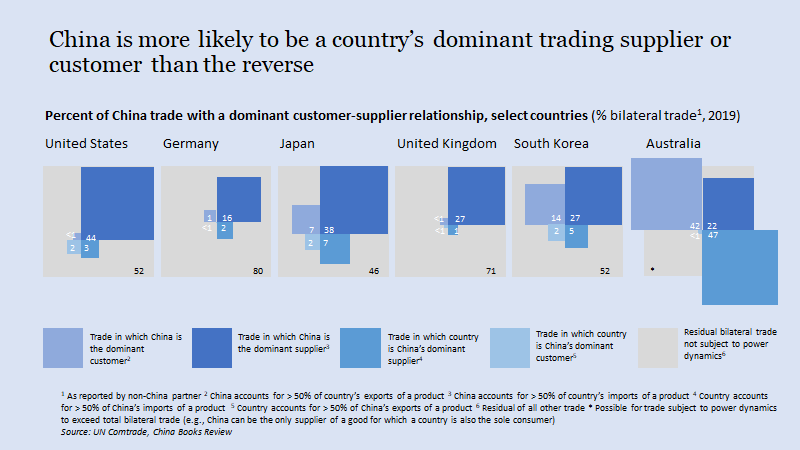

How much of China’s bilateral trade is potentially subject to power dynamics? Using UN Comtrade data, China Books Review calculated the proportion of trade in which China was a country’s dominant supplier or customer, defined as when China accounted for 50% or more of a country’s respective imports or exports of a particular good.

For the United States, 2019 trade equivalent to $250 billion, or 44% of total trade between the two countries, were in products in which China was a dominant supplier. High value examples include mobile phones, laptops, office furniture, and game products. Among other major trading economies, Germany has the smallest proportion of bilateral trade in which China is the dominant supplier, at 16%.

China finds itself in the reverse position of being reliant on a single country as supplier or customer far less often. Japan leads with $22 billion of exports that China sources principally from that nation. High value examples include passenger vehicles, engines, and, less expected, sanitary products. Among the six trading partners considered, only $21.6 billion were in goods in which a country was the dominant customer of a Chinese export product.

The value of Australia’s trade subject to power dynamics actually exceeds the total value of bilateral trade itself. This is because it is possible for the same good to be counted twice: for instance, China is the predominant customer of a good for which a country is also the predominant provider to China. Leading examples for Australia include: cattle, goats, and dairy products. (A discrepancy can also be introduced because of differences in bilateral trade totals reported by each country; this analysis uses the non-Chinese country as reporter for this calculation.)

While the analysis reveals aggregate leverage and hints at how China might opt between boycotts or blockades depending on the country, it obscures the reality that when most countries weaponize trade, they are ultimately solving for political instead of economic impact. That is, an action that narrowly targets goods from the state of an influential senator or riles a politically powerful lobby can often achieve the desired effect while minimizing blowback to their own economy.

There are other limitations to this analysis. Trade in goods is only one type of flow potentially subject to leverage. Trade in services, financial and investment, and data flows can also be targeted and the United States also derives significant leverage from the dollar’s status as the world’s reserve currency. The analysis does not consider the potential for leverage over foreign companies with large production and sales within China, which would not appear in trade data. Apple and Volkswagen are high-profile examples. The analysis also understates potential downstream impacts of important intermediate inputs which, if disrupted, would cripple domestic production. Consider for instance a component which, while of limited value on its own, prevents a multi-million dollar airliner from being completed. Finally, the analysis does not reflect leverage from goods that aren’t traded because they are subject to export controls.

While broad decoupling is neither advisable nor feasible, diversification and investments in automation and additive manufacturing that can revitalize domestic production are worth pursuing. Meanwhile, economic statecraft will only grow in importance.